In today’s economic landscape, understanding how taxes impact financial transactions is crucial for both individuals and businesses alike. One such tax that plays a significant role in many countries’ fiscal policies is the Goods and Services Tax (GST). Whether you’re a business owner, a financial analyst, or simply someone interested in managing personal finances efficiently, knowing how to calculate the GST-inclusive amount can be immensely beneficial. In this blog post, we’ll delve into the fundamentals of calculating the GST-inclusive amount using the 18% GST formula, providing you with an easy calculation guide.

Understanding GST Formula

GST is a consumption tax levied on the supply of goods and services. It’s designed to be a comprehensive tax on the value-added at each stage of production or distribution. The GST-inclusive amount refers to the total amount including both the original price of the product or service and the GST.

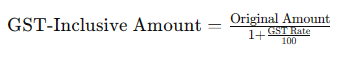

The 18% GST Formula: To calculate the GST-inclusive amount when the GST rate is 18%, we use a simple formula:

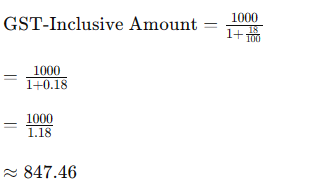

Example Calculation: Let’s say you have an original amount of $1000 and the GST rate is 18%. To find the GST-inclusive amount:

So, the GST-inclusive amount of $1000 at an 18% GST rate is approximately $847.46.

Benefits of Knowing GST Calculation:

- Accurate Financial Planning: Understanding how GST impacts your expenses allows for better financial planning and budgeting.

- Business Efficiency: For businesses, knowing the GST-inclusive amount aids in pricing strategies, invoicing, and tax compliance.

- Consumer Awareness: Consumers can make informed purchasing decisions by understanding the total cost of goods and services inclusive of GST.

Conclusion:

Mastering the calculation of GST-inclusive amounts empowers individuals and businesses to make informed financial decisions. With the 18% GST formula and easy calculation guide provided in this blog post, you can confidently navigate through transactions, budgeting, and taxation processes. Whether you’re crunching numbers for personal finances or business operations, having a solid grasp of GST calculations is an invaluable skill in today’s dynamic economic environment.